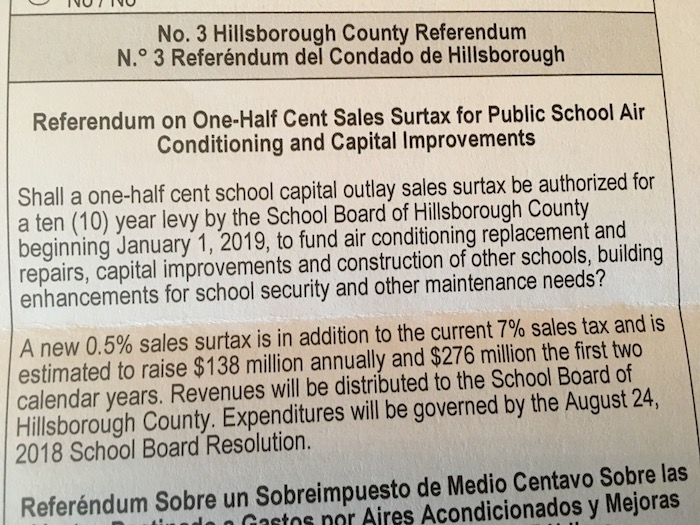

What new Hillsborough County sales tax for education means

Read what the Hillsborough Education Referendum seeking a half-penny sales tax increase would mean for you and for public schools.

The increased sales tax passed by Hillsborough voters will generate about $1.3 billion over 10 years, with at least $500,000 invested in each of the district’s 230 schools.

A typical family will pay $63 a year, with a portion paid by tourists and other visitors making purchases.

Grayson Kamm, Communications and Media Officer for the public school system, provided 83 Degrees with the following facts about what passage of the additional sales tax will mean for Hillsborough County Public Schools

The half-penny sales tax to benefit schools will fund:

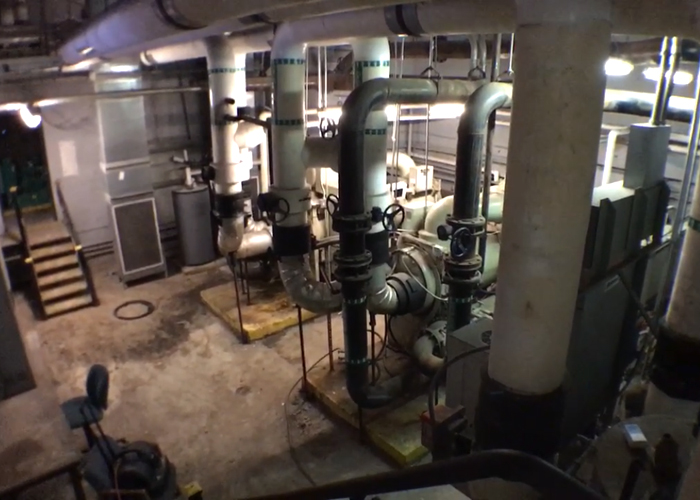

1. 1,785 specific projects designed to improve learning conditions in public schools including 203 A/C replacements, 63 aging roof replacements, $23 million in safety and security improvements, $25 million in classroom technology upgrades, and build four new schools to relieve overcrowding.

“The state does not fund school buildings based on age or need, so as our schools age, the need increases but the funding does not,” Superintendent Jeff Eakins says. “Because of this, with our average school’s age of 50 years old, students and teachers are struggling in hot classrooms with inadequate equipment.”

2. An unpaid independent Citizen Oversight Committee will watch all spending. Members cannot work for the school district or profit from referendum projects.

The initial oversight committee will be headed by former Florida Education Commissioner Betty Castor, and include as members Hillsborough County Sheriff Chad Chronister, former Hillsborough Schools Superintendent Earl Leonard, former Hillsborough Community College CFO Bonnie Carr, former Florida Legislator Ed Narain, and local business leader Jose Valiente.

3. Studies show that investing in schools increases property values, attracts high-quality businesses, ensures safe shelters during hurricanes, and improves students’ performance.

4. Voters in every neighboring county — Pasco, Pinellas, Polk, and Manatee — have already approved significant local tax referendums to support their public schools.

5. While it was promised as an extra boost for schools 30 years ago, local school districts are getting a decreasing portion of funding from the Florida Lottery as the state Legislature shifts priorities. This year Hillsborough County receives $9.1 million in Lottery dollars, about 0.3 percent of Hillsborough’s $3.014 billion school district budget.

6. The school sales tax increase would last 10 years before a decision would be made about whether to renew.

7. The half-penny sales tax increase will cost a typical family in Hillsborough County $63 a year, based on IRS tax tables and Hillsborough’s median household income of $51,681.

8. Supporters included the United Way Suncoast, Tampa Downtown Partnership, South Tampa Chamber of Commerce, Greater Tampa Chamber of Commerce, North Tampa Bay Chamber of Commerce, Greater Temple Terrace Chamber of Commerce, the Tampa Bay Times editorial page, and La Gaceta.

10. For more information, visit the Hillsborough County Public Schools website and the Strengthen Our Schools website.