Commentary: The power of business inclusion in Tampa Bay

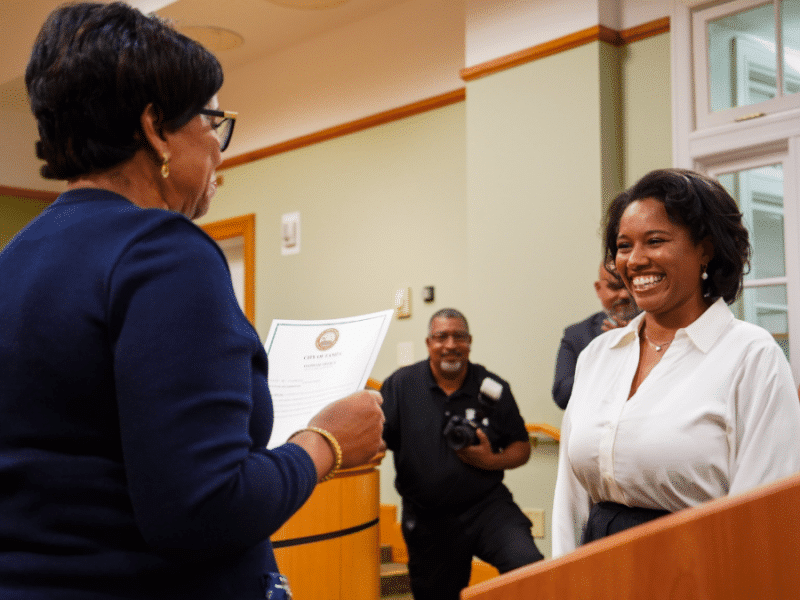

Florida State Minority Supplier Development Council President and CEO Beatrice Louissaint discusses the importance and benefits of helping minority-owned businesses in Tampa Bay and elsewhere scale.

Minorities and women make up 68% of the U.S. population, but the businesses they own win just 5% of Fortune 500 business spending. Government agencies primarily do business with majority-owned companies and most do not meet their own annual goals regarding doing business with minority and women-owned businesses.

If minority-owned businesses were able to double the business that they do with Fortune 500 companies and governmental institutions, millions of jobs would be created and wealth would grow in communities of color.

In Tampa and other cities in the Suncoast, programs that effectively develop minority businesses should be an important component of strategies to tackle the crisis of low wages that is plaguing the region. Minority entrepreneurs often hire more minorities and are more likely to take chances on those whom many consider hard to place or unemployable.

Tampa’s regional economy is fueled by small and minority-owned businesses. Both the private and public sectors need to identify strategies to accelerate the growth of minority businesses that are past the first stage of development. These companies require resources and support to grow into mid-size and large companies with significant workforces and high-paying jobs. The dividends are potentially high: Nationally, businesses of 10 or more employees account for more than 70% of job creation and revenue growth among minority-owned companies, according to an Endeavor Insight report. Yet, only 19% of Black-owned businesses and 20% of Hispanic-owned businesses reach this scale, according to that same report.

In addition to creating jobs, entrepreneurs who scale companies are more likely to create generational wealth – property and financial gifts that are inherited or transferred to younger generations, and which tend to have a lasting positive effect on families. Endeavor Insight’s research shows that owning a company that has grown to at least 10 employees “would provide enough economic value to move the median Black or Hispanic household to a financial position greater than that of the median U.S. family.”

Investments in helping minority-owned businesses scale up are likely to have other dividends as well. For example, entrepreneurs with businesses of this size have garnered knowledge, expertise and connections that they often share with other members of their communities. More minority-owned businesses of this size would also help counter the “brain drain” of Black and Hispanic talent from the Tampa Bay area.

Unfortunately, Endeavor Insight identified what it calls a “scaling gap” – minority entrepreneurs are more likely to aspire to grow their companies, yet are less likely to do so than other founders. Our community can bridge this gap through programs specifically targeted to helping minority-owned businesses scale up. In the diverse city of Tampa with a rich urban life, the impact will be tremendous.

Beatrice Louissaint is President and CEO of the Florida State Minority Supplier Development Council (FSMSDC), one of 23 regional councils affiliated with the National Minority Supplier Development Council. The FSMSDC acts as a liaison between corporate America and government agencies and Minority Business Enterprises in the state of Florida. Learn more about the FSMSDC’s programs and services at fsmsdc.org, or call (305) 762-6151.